U.S. Department of Labor

Employee Benefits Security Administration

April 2023

When you get investment recommendations on your retirement accounts, it is important to know whether the person giving you that advice is a “fiduciary” under Title I of the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code (together, these are federal laws that are specifically applicable to retirement accounts).(1) When investment professionals are fiduciaries under Title I of ERISA or the Code, they have important obligations designed to protect your interests.

Under Title I of ERISA and the Internal Revenue Code, fiduciary investment advice providers cannot receive payments that create conflicts of interest, unless they qualify for an “exemption” issued by the Department of Labor. The professionals you hire to provide investment advice to you typically are investment advisers, broker-dealers, banks, or insurance companies along with their employees, agents, and representatives.

The Department recently issued a new exemption for fiduciary investment advice providers who have conflicts of interest that could affect their interactions with retirement investors, called Improving Investment Advice for Workers & Retirees. The new exemption became available for fiduciary investment advice providers on February 16, 2023, and they must satisfy important investor protections, including a best interest standard, to use the exemption. It is important to note that the protections in the new exemption are (1) in addition to the legal requirements and standards imposed by other regulators, and (2) only apply when a fiduciary provides investment advice to you about your retirement accounts.

This publication includes a list of questions that you should consider asking before relying upon investment advice from investment advice providers regarding your retirement accounts along with some additional background information to help you understand the purpose of each question.

This publication also includes some answers to frequently asked questions (FAQs) about the Department of Labor’s new Improving Investment Advice for Workers & Retirees exemption. Because of the wide variety of arrangements and investment advice providers (including those who serve retirement investors in both fiduciary and non-fiduciary capacities), it is important to ask these types of questions before relying upon investment recommendations.

Questions to Ask an Investment Advice Provider

Are you a fiduciary under the federal laws specifically applicable to retirement accounts (Title I of ERISA and the Internal Revenue Code) when you give me investment advice for my retirement account?

-

Investors in retirement plans, such as 401(k) plans and individual retirement accounts (IRAs), have special legal protections under the federal laws specifically applicable to retirement accounts if they receive advice from a fiduciary.

-

Such fiduciaries must avoid transactions that involve conflicts of interest unless they qualify for and comply with the conditions of an “exemption” issued by the Department of Labor.

Can I have a written statement that you are a fiduciary under the federal laws specifically applicable to retirement accounts (Title I of ERISA and the Internal Revenue Code) when you make investment recommendations to me for my retirement accounts? If not, why not?

-

If your investment advice provider states that they are acting as a fiduciary, you should ask for that representation in writing.

-

A written statement helps ensure that the fiduciary nature of the relationship is clear to both you and the investment advice provider at the time of the transaction, and limits the possibility of miscommunication.

Are you and your firm complying with the Department of Labor’s exemption, Improving Investment Advice for Workers & Retirees (also referred to as PTE 2020-02)? If you are not relying on the exemption, are you relying on another exemption previously issued by the Department, or do you believe that you do not have any relevant conflicts of interest?

-

The Improving Investment Advice for Workers & Retirees exemption requires your investment advice provider to comply with conditions designed to protect you as a retirement investor. These conditions require investment advice providers to:

- Give advice that is prudent,

- Give advice that is loyal,

- Avoid misleading statements about conflicts of interest, fees, and investments,

- Follow policies and procedures designed to ensure that they give advice that is in your best interest,

- Charge no more than is reasonable for their services, and

- Give you basic information about their material conflicts of interest.

-

If your investment advice provider is a fiduciary but says they are not relying on the new exemption or a previously issued exemption, ask them why.

-

For more information on the Department’s Improving Investment Advice for Workers & Retirees exemption, see the FAQs below.

What fees and expenses will I be charged? Will you give me a list of those fees and expenses, and explain what each pays for? Do I pay all them directly to you or are any taken out of my investments?

-

Fees and expenses can be charged and paid for in different ways.

-

You should be sure you understand the overall cost associated with using a particular investment advice provider and the conflicts of interest that may affect the quality of advice that they provide. You can even use this information to shop around for the best combination of cost and service.

-

Fees and expenses for your retirement account and investments can have a significant impact on your retirement savings.

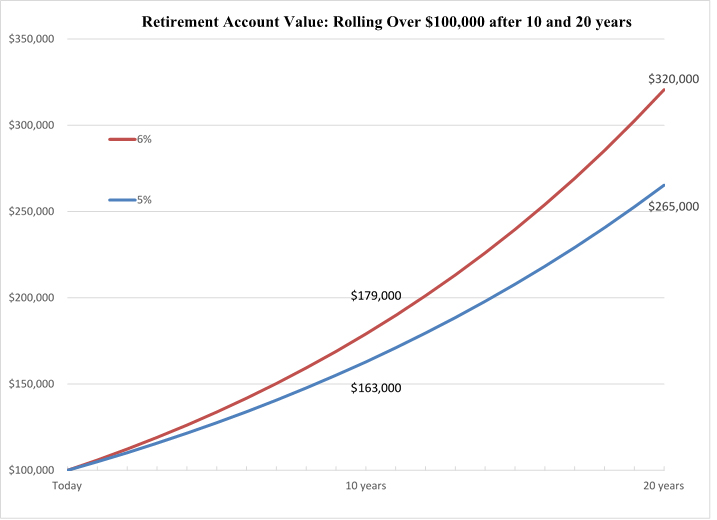

For example, let’s say you want to roll over $100,000 from your 401(k) account into an IRA. One firm pays your investment advice provider more for recommending certain investments. If you follow their recommendations, the fees will be 1% more than comparable investments, every year. As a result of these higher fees, instead of earning say, 6% each year, your IRA earns only 5%. That difference might seem small, but it adds up over time. Based on an initial investment of $100,000, an IRA earning 6% would grow to $179,000 in 10 years. But with an extra 1% in fees, you would earn only 5% and your $100,000 would grow to just $163,000. In other words, that extra percentage point in fees would cost you $16,000. And as more time passes, that 1% difference in fees gets magnified. During the next 10 years your IRA would lose out on another $39,000. You would only have $265,000 while someone who earned the full 6% would have $320,000. That’s $55,000 more than you!

What conflicts of interest do you have in making investment recommendations to me? Do you or your firm get paid from any other sources in connection with my business with you? Do you or your firm pay anyone else because I opened an account with you or because I make investments that you recommend? Will you give me a written statement describing these payments and the amounts of these payments?

-

Fees and expenses can be charged and paid for in different ways.

-

In addition to any fees or charges that you may pay directly, your investment advice provider might receive compensation from the firms whose products they recommend or from other sources.

-

An investment advice provider has a conflict of interest when the provider is paid more to recommend certain products or accounts rather than to recommend what is in your best interest. You might be unaware of these payments, particularly if information is hidden in fine print or not disclosed at all. These fees can create an incentive to make recommendations that generate the highest fees for the investment advice provider, rather than the best investment return for you.

-

Understanding who ultimately is paying your investment advice provider for recommending a particular investment can help you understand these conflicts. The investment advice provider or their firm may stand to make more money with some recommendations than others. Your investment advice provider should clearly explain these conflicts of interest to you before you rely on their advice.

-

To help protect you from harmful conflicts of interest, the Improving Investment Advice for Workers & Retirees exemption (see additional FAQs below) requires that fiduciary investment advice providers:

- Give advice that is prudent,

- Give advice that is loyal,

- Follow their firm’s policies and procedures,

- Avoid misleading statements about conflicts of interest, fees, and investments,

- Charge no more than is reasonable for their services, and

- Give you basic information about their material conflicts of interest.

Are there any limitations on the investments you will recommend? If so, what are they? For example, do you limit your recommendations only to your firm’s investment products (“proprietary products”) or do you recommend investments from other firms?

-

Investment advice providers can limit the investments they offer for a variety of reasons.

-

Some offer products that are put together by your investment advice provider’s firm or certain other companies with shared ownership or management (these products are generally known as “proprietary products”).

Under what circumstances will you monitor the investments in my retirement account, and make recommendations for changes in my investments as circumstances warrant?

-

Some investment advice providers will monitor your retirement account and recommend changes to your investments if it appears that you should change course. However, monitoring is not required.

-

Not all providers offer monitoring. When choosing an investment advice provider, do not assume that they will monitor the investments in your account or tell you when to change your investments. You can ask whether the provider offers this service and how much it will cost. If the investment advice provider will monitor your investments, you should ask them how frequently the monitoring occurs, and what events may result in your investment advice provider reaching out to you.

Why are you recommending that I roll money out of my current 401(k) account, pension, or IRA? Will rolling money out better serve my interests and retirement goals?

-

Your employer-sponsored plan may be your single largest source of retirement savings.

-

If your money or investments stay in an employer-sponsored plan (such as a 401(k) or pension), they get special protections under Title I of ERISA that do not apply to IRAs or non-retirement accounts.

-

In addition, your investments, investment management structures, and associated fees are likely to change upon rollover, and these changes could be harmful if you followed bad advice to make the rollover.

-

There are many factors to consider when considering rollovers, including differences in expense, available investments, services, and distribution options. So, if your investment advice provider recommends a rollover, ask a lot of questions so that you can be sure you understand the reasons for the recommendation and whether it’s right for you. Important questions include:

- Will I have to change my investments if I move my retirement savings to an IRA or a different 401(k)?

- How do the fees and expenses compare to what I pay now?

- Why do you think a rollover is better than leaving my retirement savings in my current 401(k), pension, or IRA?

- Would a different mix of investments in my current 401(k) or IRA serve me better than rolling my retirement assets out?

- Is there a difference in the types of distributions I can take?

- What are the possible tax consequences of following your advice?

Frequently Asked Questions About the Exemption on Improving Investment Advice for Workers & Retirees

The following Frequently Asked Questions focus on the Department of Labor’s new Improving Investment Advice for Workers & Retirees exemption.

Why did the Department adopt the Improving Investment Advice for Workers & Retirees exemption for fiduciaries who give investment advice?

You deserve to receive investment advice that is in your best interest, and fiduciary investment advice providers deserve to be paid a fair and reasonable fee for their advice. Also, you should be able to pay for advice any way you would like to, such as through commissions, an hourly fee, or a percentage fee based on the value of the account. Some types of common compensation for advice, such as commissions, however involve conflicts of interest and therefore are prohibited under federal laws specifically applicable to retirement accounts, unless your advice provider complies with exemption conditions designed to protect your interests.

One exemption recently issued by the Department of Labor, called the Improving Investment Advice for Workers & Retirees exemption, allows your fiduciary investment advice provider to be paid in these different ways under conditions designed to ensure that you receive advice that is in your best interest.

Although other exemptions are available to fiduciary investment advice providers, the Department expects that many providers will choose to rely on it due to its flexible, principles-based approach.

How do I know if my investment advice provider is a fiduciary relying on the exemption?

Investment advice providers who may rely on the exemption include investment advisers, broker-dealers, banks, and insurance companies along with their employees, agents, and representatives. An investment advice provider who is relying on the exemption must give you a written statement that they are a fiduciary. Some investment advice providers may use model language provided by the Department.

You can always ask your investment advice provider if they are a fiduciary under the federal laws specifically applicable to retirement accounts and if they are relying upon the Department’s Improving Investment Advice for Workers & Retirees exemption (also known as PTE 2020-02), to ensure you are fully informed about the advice arrangement. Remember to have them put it in writing.

I received a document from my investment advice provider called a Client or Customer Relationship Summary (also called Form CRS). Is that document required by the exemption?

You may receive information from your investment advice provider that is required by another regulator, such as the Securities and Exchange Commission (SEC). Form CRS and its related rules require SEC-registered investment advisers and SEC-registered broker-dealers (together, “firms”) to deliver to retail investors a brief customer or client relationship summary that provides information about the firm.

The investment advice provider giving you advice in your retirement account may be a broker and/or adviser that is registered with the SEC and may therefore be required to give you this document. It is important to note that the protections in the Improving Investment Advice for Workers & Retirees exemption are in addition to the legal requirements and standards imposed by other regulators, such as the SEC, and the exemption’s protections apply only in the context of a fiduciary providing investment advice to you about your retirement accounts.

For questions about SEC requirements, visit SEC.gov or Investor.gov, the SEC’s website for retail investors. Investors can also learn more about broker-dealers, investment advisers, and the SEC’s Form CRS at Investor.gov/CRS.

What does it mean to have investment advice provided in my best interest under the standards of the exemption?

To comply with the exemption, investment advice providers must put your financial interests before their own competing financial interests. When providers operate under the exemption’s best interest standard, they must investigate and evaluate investments, make recommendations, and exercise sound judgment as a knowledgeable and impartial professional. Their investment recommendations must be based on your interests, not theirs. This means that, for example, in choosing between two investments, it is not permissible for the investment advice provider to recommend investing in the one that is worse for you but better for their bottom line.

Does the exemption’s best interest standard mean that my investment advice provider is automatically on the hook if I lose money in my retirement account when I follow his or her recommendation?

No. The exemption’s best interest standard focuses on the investment advice provider’s behavior at the time they make a recommendation to you, rather than how the investment ultimately performs over time. Therefore, your investment advice provider is not necessarily responsible if your investment loses money. Even the best investments typically involve some risk of loss and are likely to go up and down in value over time.

Does the exemption’s best interest standard mean that my investment advice provider must search for and identify the absolute best investments for me?

No. The best interest standard requires your investment advice provider to:

-

Investigate and evaluate investments, make recommendations, and exercise sound judgment as a knowledgeable and impartial professional (act prudently), and

-

Base their recommendations on your interests at the time of the transaction rather than their own competing interests (act loyally).

It does not require them to identify the absolute best investments for you out of all possible investment options.

I have a 401(k) account from my old job. Are there any protections in the exemption related to rollovers?

Under the exemption, a rollover occurs when you transfer the funds in one retirement plan or account to another retirement plan or account or from a commission-based account to a fee-based account.

If your investment advice provider is a fiduciary relying on the exemption when they recommend a rollover, the best interest standard and other protections of the exemption will apply. The exemption requires your provider to give you a written document setting out the reasons they believe the rollover is in your best interest. This includes considering your alternatives to a rollover, such as leaving the money in your 401(k) and taking advantage of other investment options available in that 401(k). The investment advice provider is expected to make diligent and prudent efforts to obtain information about your existing 401(k).

Therefore, before recommending the rollover, your investment advice provider should ask you for information on the investment options, fees, and expenses charged by your 401(k) in order to compare it to the investment options, fees, and expenses that will be charged for your new IRA. Without such information, your advice provider will not have all the information needed to give you the best possible advice. Many 401(k) plan administrators (often your employer) are required to provide plan, investment, and fee information to you. This information may be sent to you by mail or you may have access through a website. If you do not provide this information to your investment advice provider, the provider may need to rely on more general information that may not accurately and precisely represent the fees and expenses of your specific 401(k) account.

Is there anyone I can contact for more information about the Improving Investment Advice for Workers & Retirees exemption?

Yes. You can call the Employee Benefits Security Administration’s Office of Exemption Determinations at (202) 693-8540 (this is not a toll-free number).

Additional Resources

The Financial Industry Regulatory Authority’s (FINRA) BrokerCheck website is a free tool to research the background and experience of financial brokers, advisers, and firms. You can also call the BrokerCheck Help Line at (800) 289-9999.

The U.S. Securities and Exchange Commission (SEC) provides an easy way to check out an investment professional or firm using a free and simple search tool on Investor.gov. The free tool provides information about SEC-registered and state-registered investment advisers as well as the individuals who work for them. It also automatically searches FINRA’s BrokerCheck system for information about registered brokerage firms and individual brokers. The SEC has an online publication that provides tips for checking out brokers and investment advisers: Updated Investor Bulletin: How to Check Out Your Investment Professional.

The North American Securities Administrators Association (NASAA) provides contact information for your state securities regulator.

The National Association of Insurance Commissioners (NAIC) posts information about consumer education and consumer protection on insurance and retirement security.

Helpful Online Publications to Further Educate Yourself

U.S. Department of Labor’s A Look at 401(k) Plan Fees.

AARP’s Interview an Advisor.

Certified Financial Planner Board of Standards Let’s Make a Plan.

The Consumer Financial Protection Bureau’s Know Your Financial Adviser.

North American Securities Administrators Association’s Understanding Your Brokerage Account Statements.

Appendix of Additional Concepts and Terms

Conflicts of interest

An investment advice provider has a conflict of interest when the provider is paid more to recommend certain products or accounts rather than to recommend what is in your best interest. You might be unaware of these payments, particularly if information is hidden in fine print or not disclosed at all. These fees can create an incentive to make recommendations that generate the highest fees for the investment advice provider, rather than the best investment return for you. Hiring a fiduciary, as opposed to a non-fiduciary, will help ensure that your interests are protected from harmful conflicts of interest.

Conditions

The exemption requires investment advice providers that rely on its terms to meet conditions designed to protect your interests. The conditions should ensure that you receive investment advice that is in your best interest and is insulated from the harmful effects of conflicts of interest. One of the conditions of the exemption requires your investment advice provider to give you a written statement that they are a fiduciary under the federal laws specifically applicable to retirement accounts. As described in the previous question, this written statement confirms that the investment advice provider is a fiduciary under these laws and is obligated to give you advice that is in your best interest. The exemption also requires fiduciary investment advice providers to give you additional information in writing, including a description of the services they are providing and certain conflicts of interest. The exemption’s most important conditions require that investment advice providers:

- Give advice that is prudent,

- Give advice that is loyal,

- Avoid misleading statements about conflicts of interest, fees, and investments,

- Follow policies and procedures designed to ensure that they give advice that is in your best interest,

- Charge no more than is reasonable for their services, and

- Give you basic information about conflicts of interest.

Fiduciary

Under Title I of ERISA and the Internal Revenue Code, a fiduciary is obligated to follow certain rules that prohibit harmful conflicts of interest. A fiduciary that relies on the Improving Investment Advice for Workers & Retirees exemption must:

- Give advice that is prudent and loyal,

- Avoid misleading statements about conflicts of interest, fees, and investments,

- Follow policies and procedures designed to ensure that they give advice that is in your best interest,

- Charge no more than is reasonable for their services, and

- Give you basic information about conflicts of interest.

Fiduciary investment advice providers that avoid conflicts of interest are not required to rely on an exemption. However, if your investment advice provider says they are not a fiduciary with respect to your retirement account – or that they have conflicts of interest but are not relying on the Department’s Improving Investment Advice for Workers & Retirees exemption -- you should carefully consider hiring another investment advice provider.

Prudent

This means meeting a professional standard of care requiring them to investigate and evaluate investments, give advice, and exercise sound judgment in the same way that knowledgeable and impartial professionals would.

Loyal

This means never putting their own financial interests (or those of the firm for whom they work) ahead of yours when making recommendations.

Policies and Procedures

These help to reduce the dangers posed by conflicts of interest and ensure that they make recommendations that are in your best interest.

Proprietary Products

In fact, some only offer proprietary products. Sometimes, investment advice providers will make more money for their firm by recommending these products, instead of recommending competing investments that may be more in your interest. This could be the case when a competing investment has similar returns but pays the investment advice provider lower fees.

Special protections under Title I of ERISA

These protections include the ability to assert claims in court for violation of your legal rights as a plan participant.

Change upon rollover

For example, if your fees significantly increase after the rollover, you’ll end up with less savings at retirement. There are many other factors to consider, including differences in available investments, services, and distribution options. So, if your investment advice provider recommends a rollover, ask a lot of questions so that you can be sure you understand the reasons for the recommendation, and whether it’s right for you. Also, be sure to give your investment advice provider access to all the information available on the investment options and features of your employer-sponsored plan, so that the provider will have sufficient information to make a sound recommendation. Many 401(k) plan administrators (often your employer) are required to provide plan, investment, and fee information to you. This information may be sent to you by mail or you may have access through a website.

Model language

When we provide investment advice to you regarding your retirement plan account or individual retirement account, we are fiduciaries within the meaning of Title I of the Employee Retirement Income Security Act and/or the Internal Revenue Code, as applicable, which are laws governing retirement accounts. The way we make money creates some conflicts with your interests, so we operate under a special rule that requires us to act in your best interest and not put our interest ahead of yours.

Under this special rule’s provisions, we must:

- Meet a professional standard of care when making investment recommendations (give prudent advice);

- Never put our financial interests ahead of yours when making recommendations (give loyal advice);

- Avoid misleading statements about conflicts of interest, fees, and investments;

- Follow policies and procedures designed to ensure that we give advice that is in your best interest;

- Charge no more than is reasonable for our services; and

- Give you basic information about conflicts of interest.